The 2017 Methodology for the Drucker Institute’s Company Ranking

This is an archived page from 2017. Please visit the Drucker Institute’s company rankings overview page for the most up-to-date information.

The Management Top 250 ranking, as published in The Wall Street Journal, is based on a holistic measure of corporate “effectiveness” that was developed by the Drucker Institute, a part of Claremont Graduate University in Claremont, Calif. “Effectiveness” is defined as “doing the right things well.”

The ranking includes U.S. companies whose shares are traded on the New York Stock Exchange or Nasdaq Stock Market, and which meet criteria, described below, related to their value and prominence.

The measure seeks to assess how well a company follows a core set of principles advanced by the late Peter Drucker, a professor, consultant, author and longtime Wall Street Journal columnist. Mr. Drucker died in 2005.

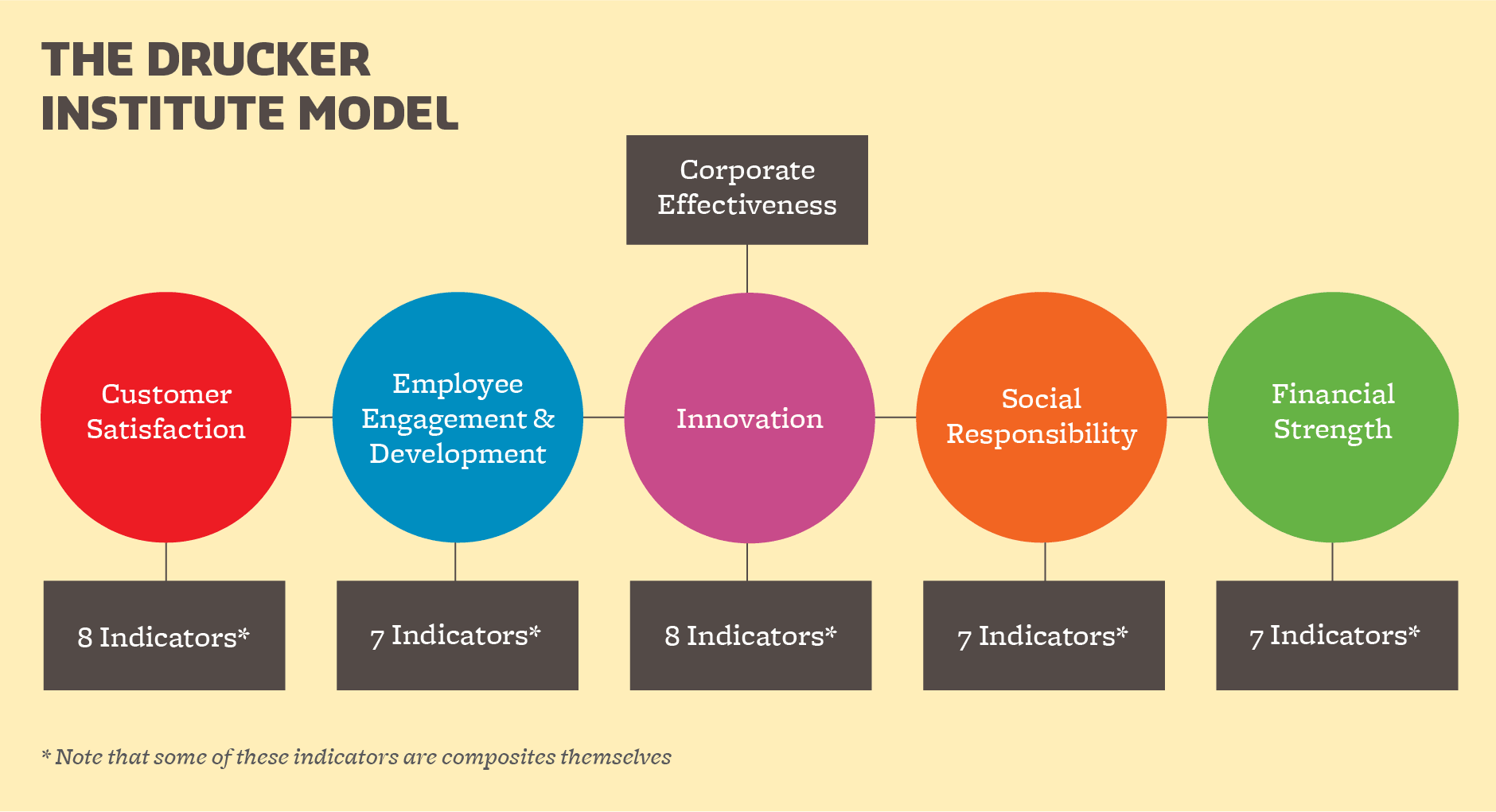

These principles serve as touchstones for five dimensions of corporate performance: Customer Satisfaction, Employee Engagement and Development, Innovation, Social Responsibility and Financial Strength. For a list of the specific Drucker principles underlying the measures, please click here.

How to Read the Rankings

All scores are expressed as T-scores. They are standardized so that the range is 0 to 100, the mean is 50 and the standard deviation is 10.

If a company is one standard deviation above the mean (with a score of 60), its results are in the top 15% to 20% of a larger universe of 693 companies that have been ranked by the Drucker Institute. If a company is one standard deviation below the mean (with a score of 40), its results fall in the bottom 15% to 20% of that larger universe.

If a company is two standard deviations above the mean (with a 70) or two standard deviations below the mean (with a 30), its results are in the top or bottom 2.5% of the larger universe. And if a company is three standard deviations above the mean (with an 80) or three standard deviations below the mean (with a 20), its results are in the top or bottom 1% of the larger universe.

The fact that a firm is ranked toward the bottom of the Management Top 250 does not mean that it is not managed effectively. The lowest-ranked firm on the list is still in the top 40% or so of a much larger group of companies that was analyzed.

How “Effectiveness” Is Measured

Much like human health, intelligence or athleticism, corporate effectiveness is a “latent variable,” meaning that it cannot be directly observed. But it can be inferred from other variables that can be observed (known as “indicators”).

In the case of the Drucker Institute’s model, there are 37 indicators that fall under the five dimensions of corporate performance.

In building the model, no one dimension of corporate performance (or any of the 37 indicators) was judged to be more important than any other. That said, because the scoring system is compensatory, a company with average or low scores in one dimension (such as Employee Engagement and Development) but exceptionally high scores in another (like Innovation) can end up highly ranked overall.

In calculating scores, a slightly different weight was computed for each dimension based on the degree to which it was found to contribute to overall corporate effectiveness. Those weights were as follows: Customer Satisfaction = 18%; Employee Engagement and Development = 20%; Innovation = 20%; Social Responsibility = 23%; and Financial Strength = 19%.

Fundamentally, the model rests on the belief that all five dimensions are interrelated and influence each other over time—what social scientists call “reciprocal causation.”

While it might be possible to untangle those influences with longitudinal data—and the Drucker Institute is actively conducting research to better understand how different parts of the model relate to one another—that is not the immediate goal of this measure. Rather, the main purpose is to provide a “snapshot” of overall corporate effectiveness at a point in time.

Development of the Model

Development of the model began in 2014, and included several prototype phases, with increasingly larger samples of companies included. Lawrence Crosby, chief data scientist at the Drucker Institute’s KH Moon Center for a Functioning Society, designed the model and, with the Drucker Institute’s Rick Wartzman and Zach First, oversaw its development.

More than 100 indicators were analyzed before settling on the 37 that ultimately went into the model. All potential indicators were judged against the following criteria:

- They needed to be rigorously developed based on sound statistical methods.

- They needed to capture the essence of a specific Drucker principle.

- They needed to have a sufficiently high correlation with the other indicators of the same dimension—providing assurance that each one was actually measuring the same aspect of corporate effectiveness. For example, each indicator in the area of Customer Satisfaction had to correlate highly with other indicators in that category.

The 37 Indicators

The indicators used in the model are based on data obtained from a variety of third-party providers. Alice Korngold, an expert on sustainability, board governance and measurement, who is chief executive officer of Korngold Consulting in New York, developed the methodology for a portion of the Social Responsibility category.

For a list of the 37 indicators, click here.

Population of Ranked Firms

Each company listed in the Management Top 250 represents one of the highest scorers among a larger universe of 608 U.S. companies that met at least one of the following criteria:

- Its market capitalization was $10 billion or greater as of Sept. 16, 2016.

- Its shares were a component of the Standard & Poor’s 500 stock index as of October 2016.

- It was a publicly traded component of the 2016 Fortune 500 list published in June 2016.

The Management Top 250 includes U.S. companies, as well as companies that have principal executive offices outside the U.S. but are listed in the Fortune 500 or have stock that is a component of the S&P 500.

To be included in the larger universe of 608 companies, at least two valid indicators had to be available for each of the five dimensions. Any company for which fewer than two indicators were available in any dimension was excluded from consideration.

Also excluded was any company that met the criteria noted above but ceased to be a stand-alone entity because it merged or was acquired before June 30, 2017.

Data Collection

The Drucker Institute obtained all of the data needed to produce the 37 indicators during the first half of 2017. In all cases, this was the most recent data available at the time.

The Financial Strength indicators cover the 12 months ending June 30, 2017.

Where available, data was obtained going back to 2012 on a year-by-year basis. This historical information provides a baseline for measuring change within each of the company’s five dimensions of performance and in terms of its overall effectiveness, as well as for spotting longer-term trends.

Scoring of Firms

Companies were scored by:

- Standardizing the raw scores on the 37 indicators to have a mean of 0 and a standard deviation of 1.

- For each dimension, averaging the company’s two or more valid indicators.

- Re-standardizing the average scores.

- Transforming the standard scores to T-scores having a mean of 50, a standard deviation of 10, and a range of 0 to 100 (except in unusual circumstances).

- Through factor analysis of those five sub-scores, computing a factor score on overall effectiveness for each firm, which, in turn, was also transformed into a T-score.

Missing Data

The underlying data used to compute the 37 indicators was not available in every instance for every firm being ranked. Where there was a missing field, a score was derived by computing the average of that dimension’s indicators for which the firm had a valid score. For example, the Customer Satisfaction category has eight indicators. If a firm had a valid score for six of those indicators, the firm’s Customer Satisfaction score became the average of the six.

The Drucker Institute compared this way of handling missing data against another method called “multiple imputation,” in which a computer analysis uses all of the known variables across the entire model to fill in any blanks. Both methods produced very similar results.

Testing and Validating the Model

To build the model, the Drucker Institute utilized structural equation modeling, a technique that uses a combination of factor analysis and multiple regression analysis to examine the relationship between measured variables and latent constructs.

This approach allowed for the analysis of the entire model simultaneously, including all proposed indicators, as well as all five dimensions of corporate performance and overall corporate effectiveness.

A series of tests was run to ensure:

- Construct validity (the degree to which the indicators actually measured what they claimed to measure)

- Reliability (freedom from random error)

- Goodness of fit (between the approach being taken and the data being examined). The goodness-of-fit statistics are: Goodness of Fit Index = 0.92, Adjusted Goodness of Fit Index = 0.91 and Normed Fit Index = 0.90.

Safeguards were also built into the model so that if a single source was used in various places (such as wRatings data going into both the Customer Satisfaction category and the Innovation category), it wouldn’t be over-weighted.

In the end, the model confirmed that:

- Taken together, the five dimensions reflect a single higher-level construct (corporate “effectiveness”) and that each has a substantial factor loading on that construct. The following are the range of loadings observed for each dimension using a variety of statistical estimation methods: Customer Satisfaction is 0.56 to 0.68, Employee Engagement and Development 0.51 to 0.66, Innovation 0.58 to 0.83, Social Responsibility 0.68 to 0.81 and Financial Strength 0.56 to 0.63.

- The selected third-party metrics serve as valid and reliable indicators of those five dimensions. The average factor loading within each dimension is 0.65.

A diagram of the structural model as specified in SPSS AMOS is available from the Drucker Institute upon request.

In addition, during the prototype phase of the model’s development, the Drucker Institute worked with PayScale to field a series of survey questions to the employees of 41 companies. These questions aimed to gauge how well these employees exhibited behaviors and mindsets that were in line with the various Drucker principles. An analysis of the results showed that companies where employees self-reported that they were adhering to the Drucker principles scored relatively high on the corresponding indicators used in the model. This convergence gave further support to the model’s validity.

Tests were also conducted to determine how volatile the model is. Too much volatility would suggest a high degree of randomness, while too little would suggest that the model is insensitive to real change. To help address this question, the Drucker Institute examined the percentage of firms that remained in different performance bands (e.g., Top 25, Top 50, etc.) for two consecutive years. Based on this, the model was found to have a level of volatility about equal to other well-known “best of” lists produced by two business publications.

Future of the Model

The Drucker Institute is committed to a process of continuous improvement. So while the principles that underlie the model are considered sacrosanct and are unlikely to change, new indicators may be introduced if they are determined to serve as better proxies for those principles.

The Drucker Institute will also continue to analyze its computational methods to ensure that they deliver fair and equitable ratings and rankings.

If you have any questions or comments, please email michael.kelly@cgu.edu.

The name “Peter F. Drucker” is a registered trademark of The Drucker 1996 Literary Works Trust. The Drucker 1996 Literary Works Trust is not a sponsor of and has not approved, authorized, reviewed or been involved in any aspect of the Drucker Institute’s company rankings.